Nordic Electricity Market supported by low hydro balance in spring 2024, Germany by Risk Premiums

Drier than normal hydro balance level in the Nordics supports prices, in Germany multiple factors keep the prices supported as well, price gap on Electricity remains significant between Nordics and the Continent.

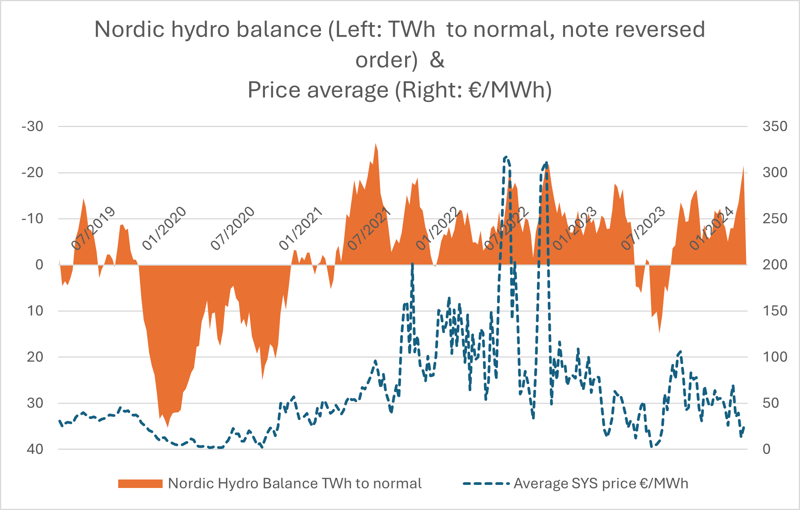

The development of the Nordic electricity market is primarily influenced by the hydro balance situation, which reflects the potential for hydro power production in the near future. In early winter 2024, the hydro balance exceeded normal levels, briefly reaching +10 TWh above normal, but declined to around -10 TWh early spring. This fluctuation is not unusual compared to the past few years, except for the high hydro balance year of 2020. However, during May, exceptionally warm and dry weather caused the hydro balance to drop significantly, varying around -20 TWh. This level has only been briefly reached since 2019, with peaks seen in autumn 2021 and twice late 2022.

With the high valuation of water at these low hydro balance levels due to very good control of hydro producers, the price difference between Nordic electricity and German electricity has usually been narrow. Currently, for both Q3 2024 and the full year 2025, the difference remains over 45 €/MWh, which we see as rather high considering the situation. After a two-week period, the hydro balance in the Nordics is expected to be -19.5 TWh below normal, slightly improved from the worst peaks this spring. Nuclear maintenance season is ongoing still in the Nordics, and some delays seen, for example in Olkiluoto 3 but also on other plants as well.

Figure 1 Source of the data: Refinitiv 28.5.2024

In the natural gas markets, EU gas storage levels are nearing 70%, trailing 2020 levels by about 3 percentage points but about 1.5 percentage points above the 2023 levels. Despite this, possibly due to geopolitical risk premiums, natural gas prices remain somewhat elevated. As of May 28, 2024, prices for 2025 and 2026 are still above 30 €/MWh. Last week, gas prices were possibly elevated by comments from the Austrian corporation OMV regarding the potential suspension of Russian gas flow due to a foreign court ruling. Austria has been heavily reliant on Russian gas compared to most of the EU countries. The front-month TTF gas product has lately somewhat followed the theoretical fuel switch costs to propane and butane. Europe is dependent on seaborne LNG deliveries, which are traded on international market. Thus, lately high demand for cooling in Asia, for example, has elevated gas prices also in Europe. Additionally, the tense geopolitical situation in the Middle East, where a significant portion of LNG deliveries worldwide is loaded, adds a risk premium. European economy outlook also plays significant role on TTF and Emission allowance market pricing, clear recovery on the sentiment is yet to be seen, possibly psychologically starting when ECB starts interest rate cuts, most likely this summer.

Electricity prices in Germany closely follow the costs of gas-fired production. Also significant factor is and will be again this late summer the availability of French nuclear, even with technical availability remaining good, too warm heating water may cause production cuts and replacement with fossil production. Additionally, the price of emission allowances has been closely correlating with TTF gas prices in recent months. Overall, there is a possibility that German electricity prices include a risk premium that could keep the price difference with Nordic electricity elevated in the derivatives markets. But given the volatility lately we consider it very much possible the gap to get narrower, possibly by the Nordic prices.

The writer, Eerik Ekström works as an energy market analyst for Gasum Portfolio Services Oy, which provides independent analysis and portfolio management under license issued by the Finnish Financial Supervisory Authority.

Would you like to get in-depth weekly updates or spot analyses? Sign up through this form.